Become a Member

Are you willing to serve your country and speak up on issues that impact United States taxpayers? Are you aware of IRS customer service or grassroots issues in your community that need to be addressed? You can influence how the IRS delivers services to the public by becoming a member of the Taxpayer Advocacy Panel.

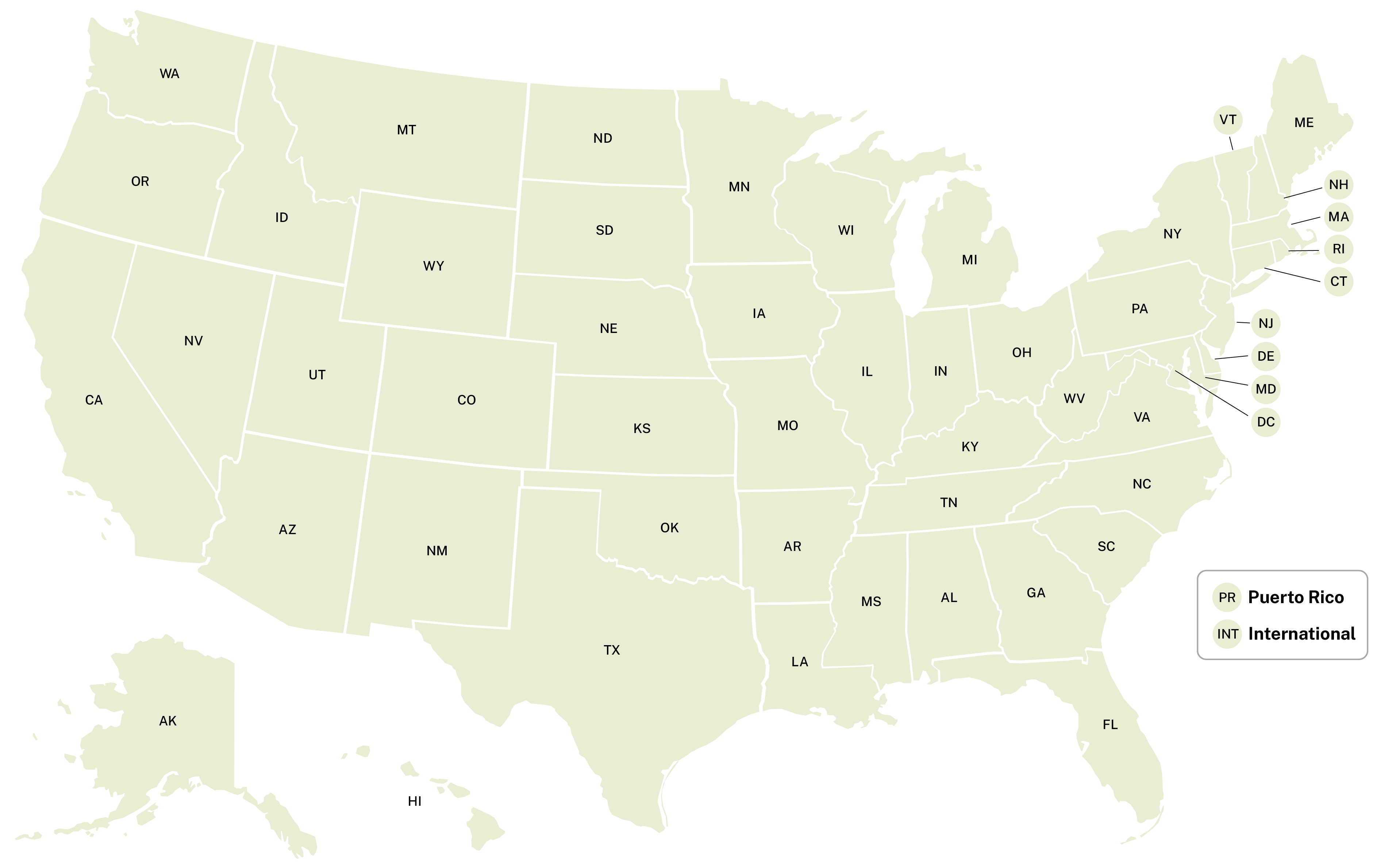

TAP normally recruits to fill member and alternate member vacancies in select states from U.S. citizens living abroad or in a U.S. territory. Selected applicants will serve a three-year membership term beginning December of the selection year, or be chosen as an alternate member to be considered if a vacancy occurs in their location during the next three years.